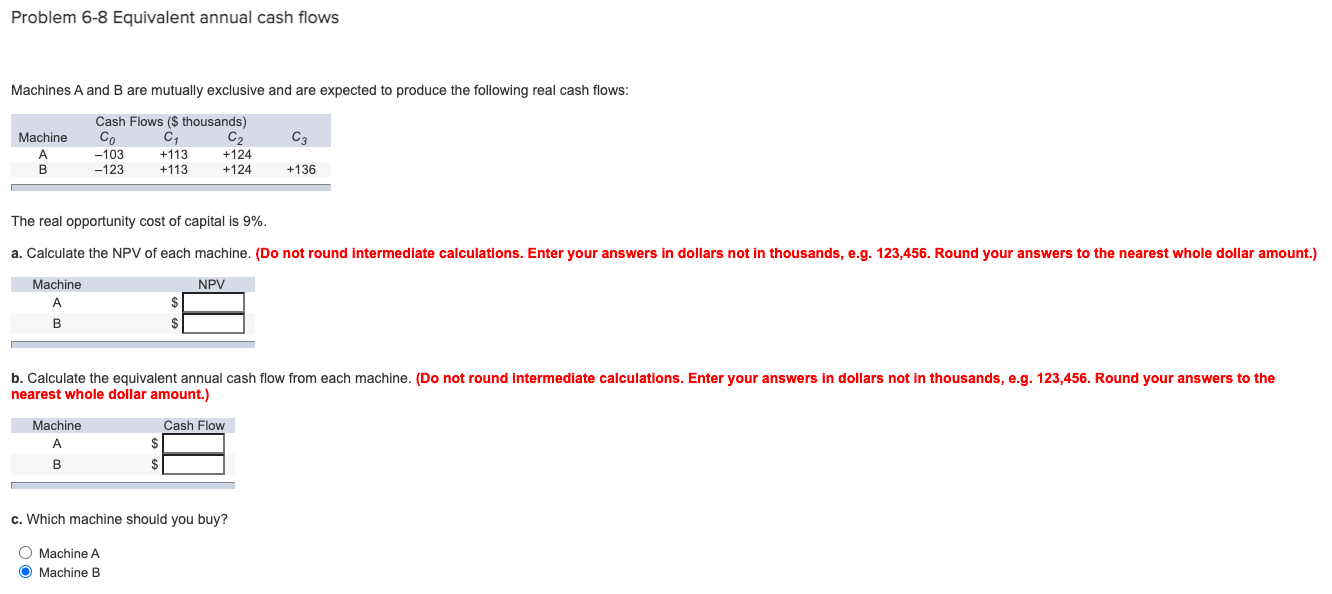

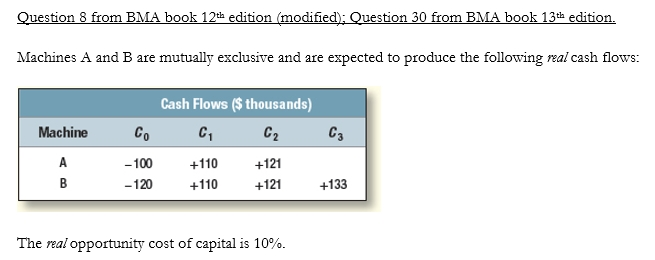

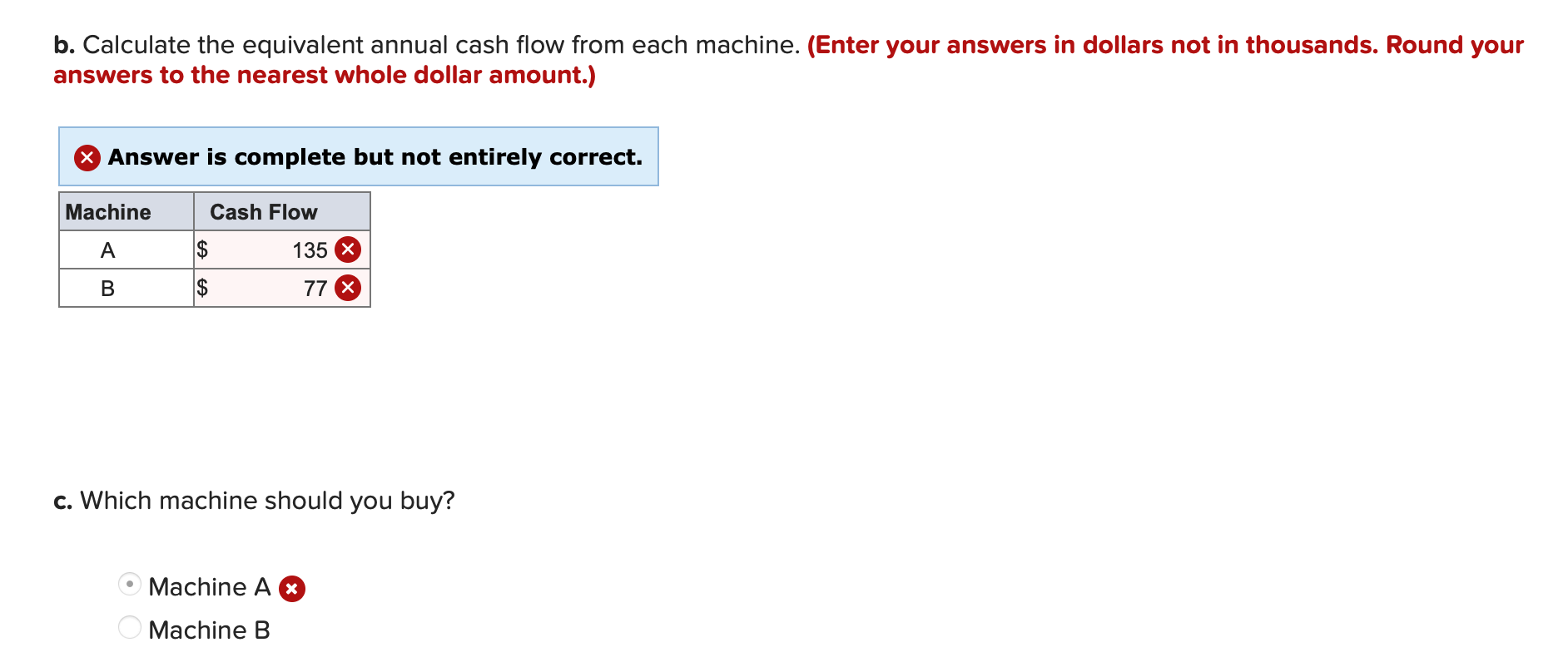

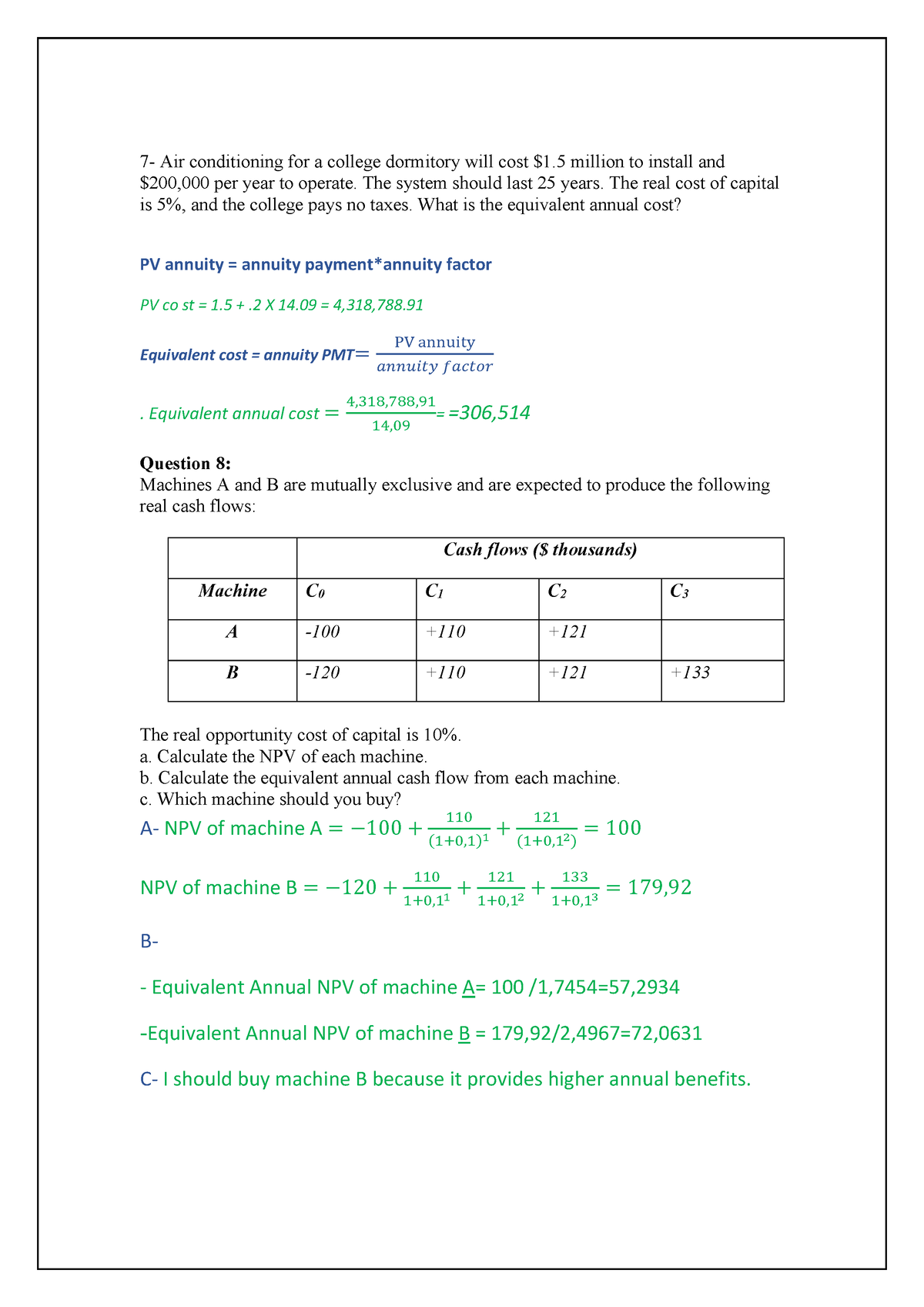

Machines A and B are mutually exclusive and are expected to produce the following real cash flows: - Studocu

Last Study Topics What To Discount IM&C Project. Today's Study Topics Project Analysis Project Interaction – Equivalent Annual Cost – Replacement – Project. - ppt download

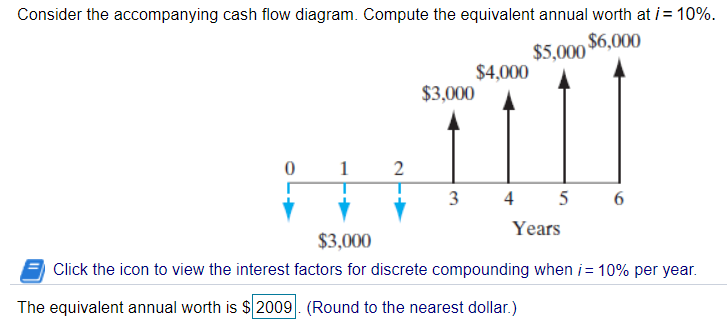

Consider the accompanying cash flow diagram. Compute the equivalent annual worth at i = 10%. (Round to the nearest dollar.) | Homework.Study.com

Last Study Topics What To Discount IM&C Project. Today's Study Topics Project Analysis Project Interaction – Equivalent Annual Cost – Replacement – Project. - ppt download

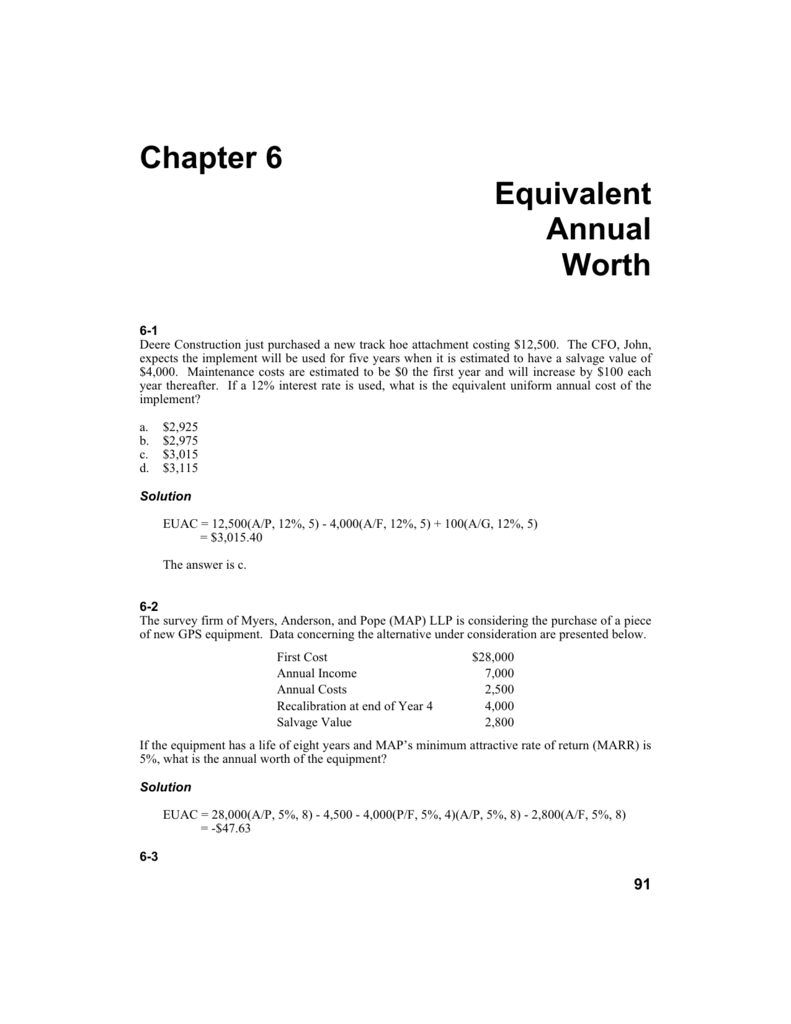

Exam 4210 Spring 2020 1. Present value is defined as: a. The current value of a future cash flow 2. If the annual interest rate

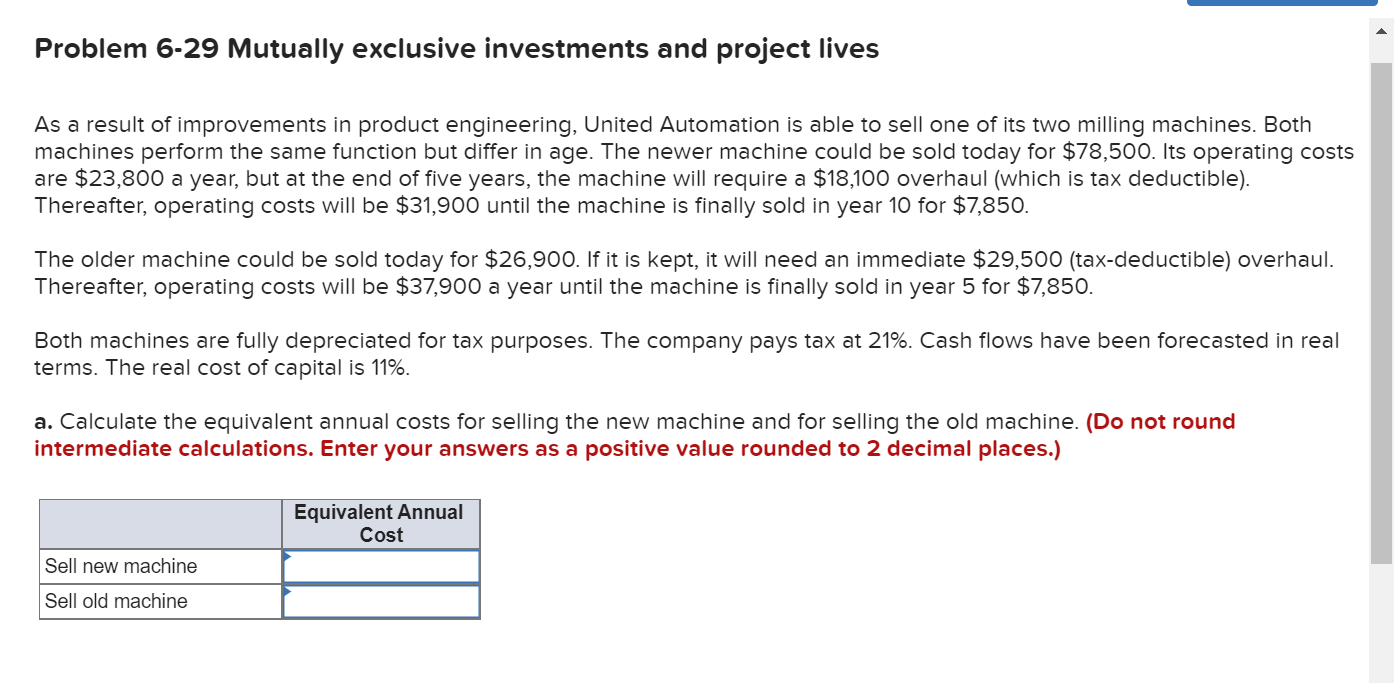

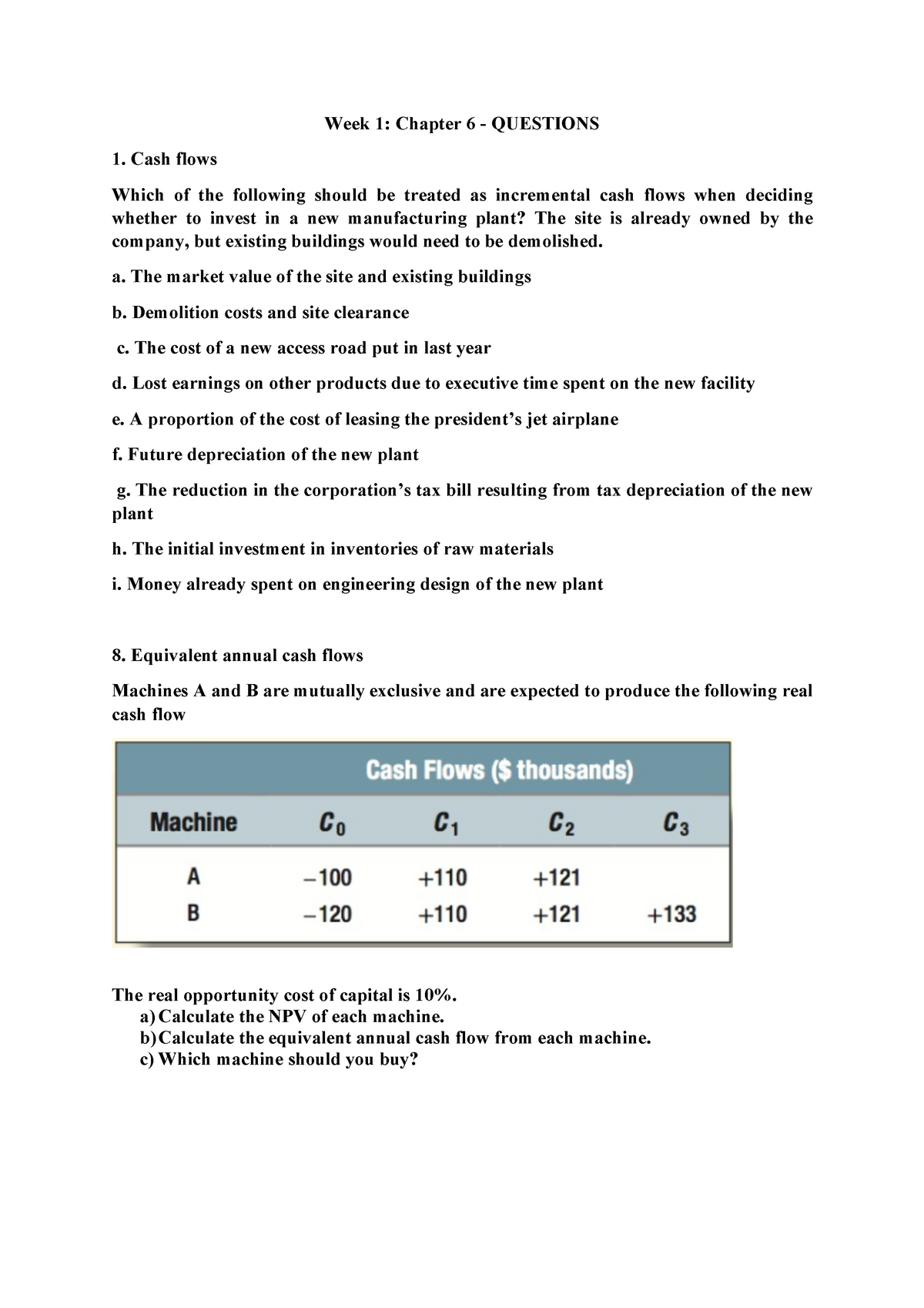

Week 1 - Chp6 - Tutorial Questions - Week 1: Chapter 6 - QUESTIONS 1. Cash flows Which of the - Studocu